How to Retire Early

How to Retire Early – Early Retirement Planning

Being able to retire early is something that most people can only dream about. The reason for this is because most people have been trained to take the wrong path towards early retirement. What do I mean?

Well, if you think about it, most people’s plan for retirement is to work until they are 65 and live off of their savings, pension, and any government assisted help that they might be able to get. We all know that social security isn’t going to be enough to allow you to keep up with your current lifestyle and quite honestly, retiring at an age where you’re a bit too old to really enjoy life and do all of the physical things that you want to do is sort of a bummer in my opinion. Let’s look at the plan that most people are on, why it doesn’t work too well, and how to retire early without being a millionaire with an internet business.

Most of us have been taught from early on through the words of our parents as well as our teachers that the best path in life is to get an education, apply for a job, work up the corporate ladder, save as much as you can, and retire when you’re in your 60′s. Although this is a plan, it’s hardly the best plan. The stats show that most people, at the age of 65, are financially broke and need help from family and the government. If you have kids that do well then it’s fine but wouldn’t it be better to not be a financial burden to them? Less than 4% of the population that retires at that age even have a decent income and only 1% will be bringing in over $100k a year during their retirement years.

Some Facts (The Reality)

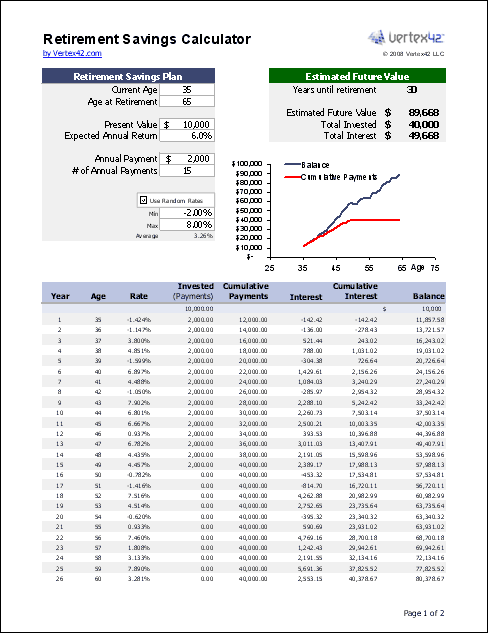

43% of people going into retirement have less than $10,000 in savings.

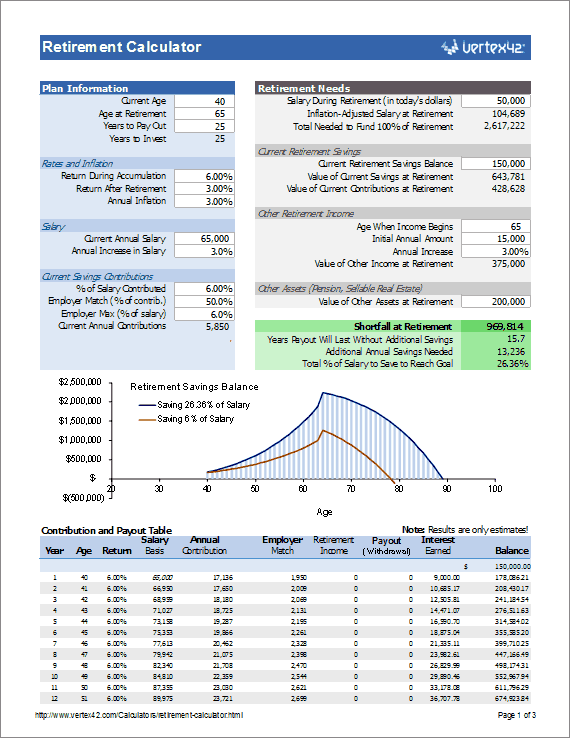

At today’s average interest rate for a savings account of about 1.5%, you will need $3.3 million in savings to have $50,000 a year to live on.

Social Security is pretty much a big Ponzi scheme and although it will pay out to the earlier baby boomers who are now retiring by the masses, the well of money will soon dry out to the later folks.

Many people who will retire within the next decade or two will realize that they can’t and will have to re-enter the workforce.

Although more and more families have both spouses working now, the financial situation hasn’t really changed much.

This is where you’re likely to be headed if you follow the norm. For many people, this is the only plan that exists in their mind. For others, they see how this plan is flawed and will do things like start a business.

Although this is a better path, it will only work if you have the right type of business. If you open up a restaurant for example and spend all of your time working, unless you are making a killing, you probably won’t be able to retire early. You’d have to hire someone to run the business for you once you are done working in order to continue to bring in an income unless you save up enough money to last you through the remaining years of your life. If this what you want to do then you better have millions saved up.

The main problem with the traditional plan of working for a company is that you will be trading your time for money. The obvious problem here is that time is a limited commodity. We only have 24 hours in a day which means your income will be limited. On top of that, since it’s dependent on you physically working, if you were ever to stop working, the income will also stop. So if this is your plan for early retirement, then chances are, it’s not going to happen unless you’re making a ton of money. Fortunately, there’s a better path in terms of early retirement planning.

How to Retire Early

Just so we’re on the same page here, to retire early means to retire well before 65. My personal definition is to retire before 40. For some people, retiring early can mean to retire before 60 while for others it’s before 30. In any case, let’s look at one of the best ways to achieve this goal. Since the plan of working for a company while trading your time for money isn’t the best plan, what you must then do is to move away from that plan. This means you will need to work for yourself and create residual income .

There are lots of ways to do this and one of the best ways is to start an internet business. The advantages of an internet business are many but the main point is to have money coming in even while you’re not working. If you have a website that gets a lot of traffic, you will be able to make money even while you’re sleeping. What does this mean in terms of your plan to retire early? Simple. It means that all you have to do is figure out how much income you need on a monthly basis to live the lifestyle you want, then, figure out how to make enough residual income to cover those expenses.

This is why you don’t need to be a millionaire to retire early. The only reason why people think they need to be a millionaire is because they are assuming that they must work for income to come in but this isn’t true at all if you have the right type of income.

Early Retirement Planning

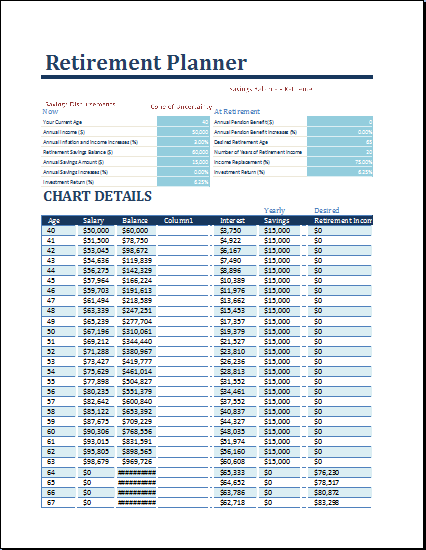

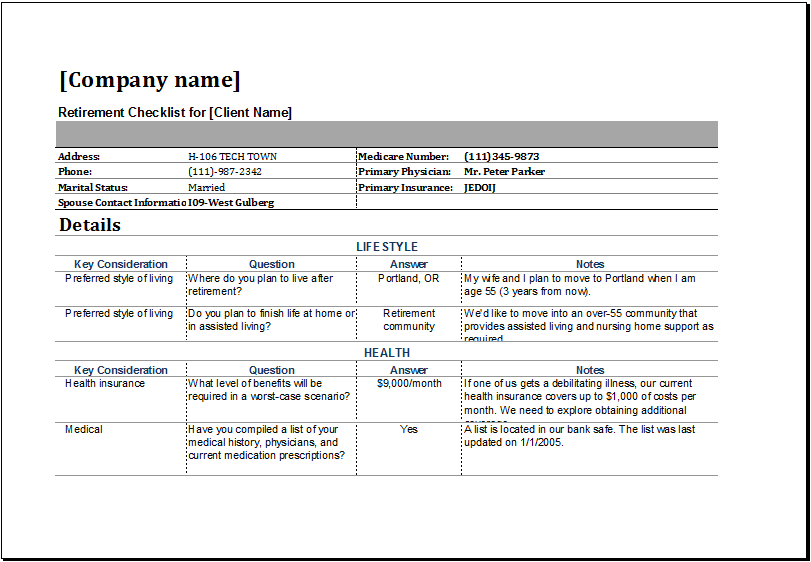

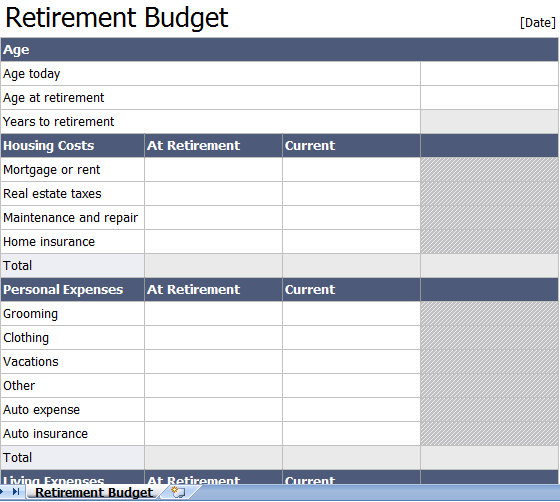

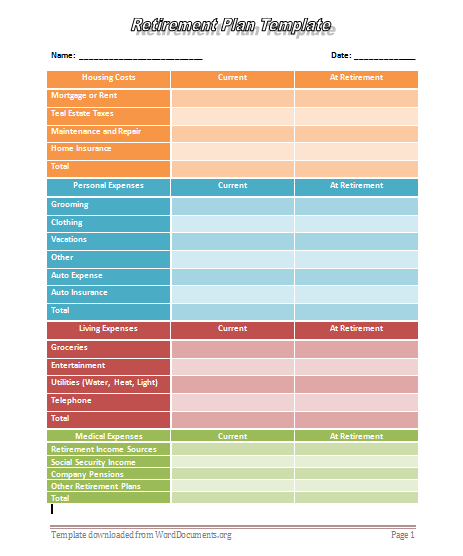

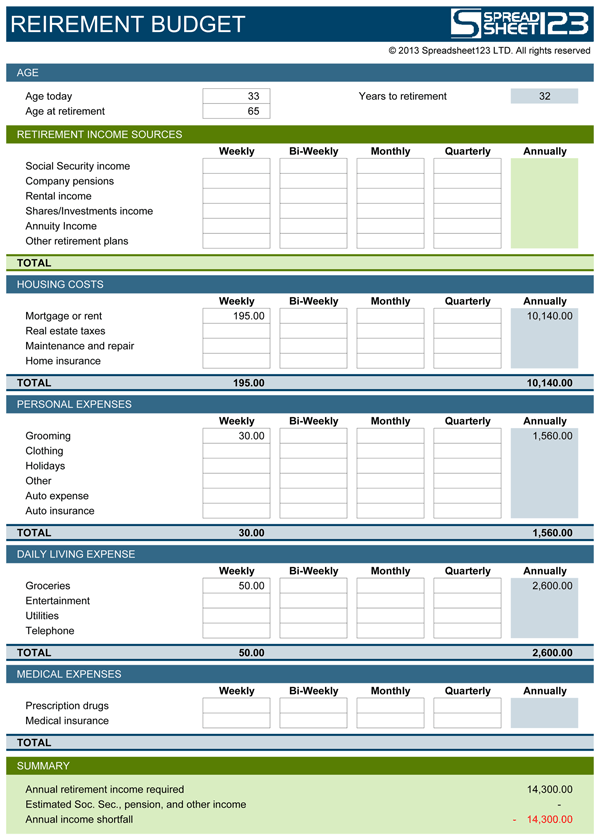

In order to make this work, you need to figure out where you are, how much you need, and how to produce that amount of passive income. You can do this simply by see how much it takes to have your current lifestyle. You will need to account for any expenses that only come once or twice a year as well such as property taxes and car insurance.

Once you figure out how much the expenses are, you will need to figure out if you want a better lifestyle or not. If you do want a better lifestyle, then the expenses will obviously increase. Once you figure out how much you need to live the kind of life that you really want, take that number and double it.

The reason why you want to double it is to account for any expenses that you might be overlooking. Also, you will want make more than you need just in case some of your income dies out. Nothing is guaranteed so good planning is key.

How to Retire Early with an Internet Business

The key to early retirement is to have residual income. Yes, saving money and investing is important as well but unless you have a ton of money to invest, it’s going to take a while. We’re talking about retiring early here, not just retiring.

The key to creating residual income with an internet home business is to pick the right niche and drive traffic to your website. I’ll be going into this more in another post but hopefully by now, you get the point that the popular path of working for a company, trading your time for money, isn’t the best way to retire early.

In fact, it’s a pretty lousy way if you look at the failure rate. Early retirement is easier than most people make it out to be. You just need to know what to do, figure out how to do it, and put all of your time and effort into making it happen. Once you achieve this goal, without needing to depend on a job, you will truly be able to experience life to the fullest.

He hey cool – nice posts!